Too Much Of A Good Thing?

Too much of a good thing is not necessarily a good thing. Too much exercise (pain), too many adult beverages (bad decisions and a bad headache). And of course, too many chocolate chip cookies (upset stomach).

But too much money? Unfortunately, from an economic perspective, the answer is too much money supply can certainly have some negative consequences as we are soon likely to find out.

Too Much Of A Good Thing?

So, what is the money supply and why is it important? While there are several standard measures for the money supply, the most common ones today are M1 and M2. M1 is the sum of currency held by the public and transaction deposits at depository institutions (banks and credit unions). M2 is M1 plus savings deposits and time deposits less than $100,000 and retail money market mutual funds. M1 and M2 are reported monthly by the Federal Reserve.

Over time, the money supply has exhibited close relationships with important economic variables. These include gross domestic product (GDP) and the price level. Accordingly, many economists have argued that the money supply provides valuable information about the near-term course for the economy. It determines the level of prices and inflation in the long run. Enter the Federal Reserve. They often uses the money supply along with other financial and economic data as a guide in setting monetary policy. The response of the financial markets and Federal Reserve policy to changes in the money supply have profound impacts on the credit markets.

Historical Trends

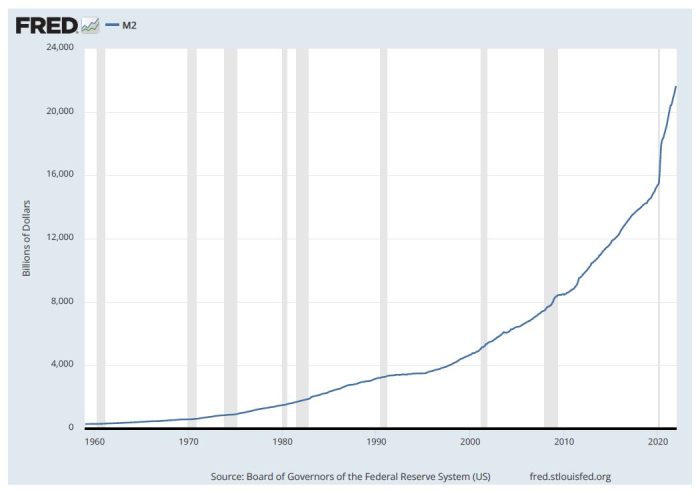

The quantity theory of money states that an increase in the money supply which exceeds the growth in real output causes inflation; there is too much money chasing fewer goods and services (see previous blog posts on Inflation: More for Less and Less for More, Part 1 and Part 2). As shown in the graph below, from 1959 to 2020 the M2 money supply averaged $4,652.3B. Compare that to the all-time high hit in November 2021 (last data available) of $21,436.7B. This is up 17% from as recent as July 2020 at $18,216.6B. This large runup in money supply is a result of lax Federal Reserve policy (quantative easing) and extraordinary amounts of government stimulus monies. Given the numbers involved, it is not difficult to see why inflation levels are hitting four-decade highs.

It is generally acknowledged that interest rates and inflation are inversely related. As interest rates decline, inflation (or potential for inflation) increases, and vice versa. The Federal Reserve has several methods for impacting the money supply and interest rates through its monetary policy.

Federal Reserve Methods

First, the Fed may increase or decrease the reserve requirements for member banks. This impacts the amount of funds available to lend. Second, they may increase or decrease the discount rate charged to member banks for short-term borrowings. The third method is through open market operations where the Fed buys or sells government securities in the open market. If the Fed wishes to increase the money supply, it will buy government bonds which provides securities dealers with cash. Conversely, if the desire is to reduce the money supply, the Fed will sell government bonds which takes in cash from the money supply. In December 2021, the Fed announced a plan to reduce holdings by at least $40B per month to reduce the money supply. The result was a 36% increase in 10-year Treasury rates from 1.4% on 12/1/2021 to 1.9% on 1/18/2022.

Finally, the Fed can adjust the Fed Funds rate directly which will directly impact short term interest rates. To date, the Fed has announced planned rate increases between 0.75% and 1.0% for 2022. And from 1.5% to 1.75% for 2023. In a recent interview with Yahoo Finance, Thomas Petterfy, founder of Interactive Brokers, indicated that increasing rates to 1 to 2% is not significant enough when considering 7% inflation. According to Petterfy, if the Fed were serious, they would need to be increasing rates to 4%, 5% or 6%.

Credit Professional Issues

The issue for all of us as credit professionals (and consumers, for that matter) is that interest rates are only going up in the near term to get inflation under control. Clearly the amount of the increase is a matter of debate. But as financial statements begin coming in for review in the next months, the low interest rate environment of the past will need to be stressed with a serious look at the impact of higher rates in the future. A 1% or 2% stress test would be a minimum for borrowers depending on the tenor of debt. A forward look at cash flows as annual risk rating reviews are performed will be imperative if the risk in the portfolio is to keep up with potential cash flow issues.

A further concern for financial institutions will be asset/liability management. Given the thin interest rate margins at most lending institutions today, a serious look at the tenor of assets and liabilities on the balance sheet will be critical. As an example, a liability sensitive balance (liabilities reprice faster than assets) will be exposed to additional interest margin pressure under the rising rate environment.

Let us Partner With You

We all knew that the low interest rate environment we enjoyed for the last couple of years would not last forever. The “about-face” to a much higher rate environment may prove painful to many borrowers and industries. Enlighten Financial would be pleased to partner with you. We can help to identify any sensitivity to the challenges that this “new normal” may entail.

Richard Rudolph is Senior Consultant at Enlighten Financial, a specialized consulting firm that focuses on loan review and risk management services to community banks and credit unions. Enlighten Financial has made it our business to shed light on the complex financial landscape. We lead clients in the right direction. We work with financial institutions and other providers to mitigate risk. To talk to Rick directly, please call: 920.445.8133.

Tags: Enlighten Financial, Too Much Of A Good Thing?

Comments are closed here.