The Agriculture Situation

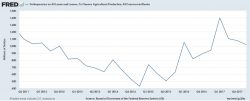

The level of past-due agriculture (ag) production loans in the fourth quarter of 2017 has not been matched in the fourth quarter since 2011. Past due loans as a percentage of total ag production loans were 1.32x in the fourth quarter of 2017 compared to 1.69x in the fourth quarter of 2011. Interestingly, the level of past-dues as a notional amount was approximately $5 million less in 2011 at $999 million compared to $1.004 billion in 2017. The 29% growth in fourth-quarter loan balances during the last six years provides insight into the reason the smaller level of overall past-dues in 2017 is actually a greater dollar value of past-dues.

It is no surprise that many family farms have been treading water over the last 2-3 years. Commodity prices have come down off their highs to a level that is now challenging for even the most efficient farm operations. Net farm income in 2016 of $61.5 billion was 45.8% lower than net farm income of $113.6 billion in 20111. The balance sheet over that same time period demonstrated a 27.1% growth in total farm debt. Farm debt as a percent of net farm income peaked in 2016 at 6.1x compared to 2.6x in 2011. This level of financial pressure led to a significant uptick in farm charge-offs in 2016.

Ag charge-offs recently peaked at $72 million in the fourth quarter of 2016 and $162 million for the year. The 2016 results exceeded the total combined charge-offs for 2013-2015 by $71 million. The level of ag charge-offs declined in the fourth quarter of 2017 to $52 million and $154 million for the year. Unfortunately, the Western District of my home state of Wisconsin led the country in 2017 in ag bankruptcies.

2018 brings continued head winds of stagnant commodity prices, increasing interest rates and a tight labor market, compounded by uncertainty with the U.S. immigration and trade policy.

I recently attended the Wisconsin Bankers Association Agricultural Banker Conference held on April 11-12, 2018. The conference included several excellent presenters who, in various ways, echoed this sentiment. Dr. Jason Henderson, Associate Dean and Director of Purdue Extension, Purdue University believes we are in the “volatility” stage of the cycle. His observations included the period of reduced ag prices we have been in and trying to identify what the bottom of this period looks like and how we get “lift” to begin to move prices in an upward direction. He believes that we are in for a period of lower profits and increased risk in the ag industry.

Dr. Matt Roberts, Managing Director of The Kermantle Group, provided insight regarding the global conditions and the ramifications to the domestic ag markets. One interesting perspective he provided was the dramatic decline of share of the world’s population living in extreme poverty. This improved state of income is directly correlated to the improvements in diet as personal income increases. This drives demand through the food chain on a global basis. This “global consumer wealth and food demand” is acting as a tailwind for the ag markets as the headwinds remain as identified above.

Even with all of these challenges, many farmers are positioned to withstand the current cycle. Unfortunately, there are farms demonstrating signs of stress and are not in a position of strength. We have seen an under-reporting of accounts payable, selling of farm assets without the proceeds being used to retire debt, delayed financial reporting, and the use of land equity to support the rollover of operating debt as ways borrowers are coping with the current status.

A well-documented loan file is a key element in managing challenged loan relationships. The file should document the loan officer’s farm visits, collateral inspections, livestock counts, projections for inputs and outputs, the marketing plan, and the plan the borrower has committed to executing to the bank. The analysis prepared by the bank should focus on the borrower’s cash flow and repayment capacity and the borrower’s historical and current ability to meet projections. A workout plan or debt restructure may become a critical component of the lending relationship. “Credits that are restructured consistent with sound banking, supervisory and accounting practices can mitigate the risk of loss to the bank.”2 “From a supervisory perspective, restructured loans to farming operations with the documented ability to repay debts under reasonably modified terms will not be subject to adverse classification solely because the value of the underlying collateral has declined.”3

Quality control, accountability, and oversight are all key components to an effective workout strategy and prudent risk management. A process with these three legs of risk management will help to ensure both the borrower and the bank are adhering to the strategy. The quality control leg can refer to the information provided from the borrower and the problem watch reports prepared by the loan officer. Accountability can ensure that things are getting done by those responsible for commitments to deliver results. Oversight by bank management can help ensure that expectations are being met and that the process is working as designed.

This period of enhanced stress in the ag markets demonstrated by increasing past-dues and charge-offs will require bankers to be resourceful in protecting the bank and working with their borrowers. Quality control, accountability and oversight are key in the effectiveness of bank/customer relationship management.

Comments are closed here.